CEO Statements

Keys to success in a record-breaking 2023

Record year

Record year

Despite a challenging market environment dominated by geopolitical upheaval and economic uncertainty as well as a sharp rise in inflation, we posted record profits in 2023: the net revenues of CHF 531.4 million and pre-tax profit (EBIT) of CHF 255.4 million significantly exceeded our expectations. First and foremost, we would like to thank our dedicated employees for enabling us to achieve these exceptional results with their commitment to delivering total customer satisfaction and top-quality service, day in, day out. Net new monies of CHF 5 billion offer further proof of our value proposition. As of the end of the year, 574’274 clients trusted us with assets totalling CHF 58 billion – a real vote of confidence.

Success doesn’t just happen – we make it happen

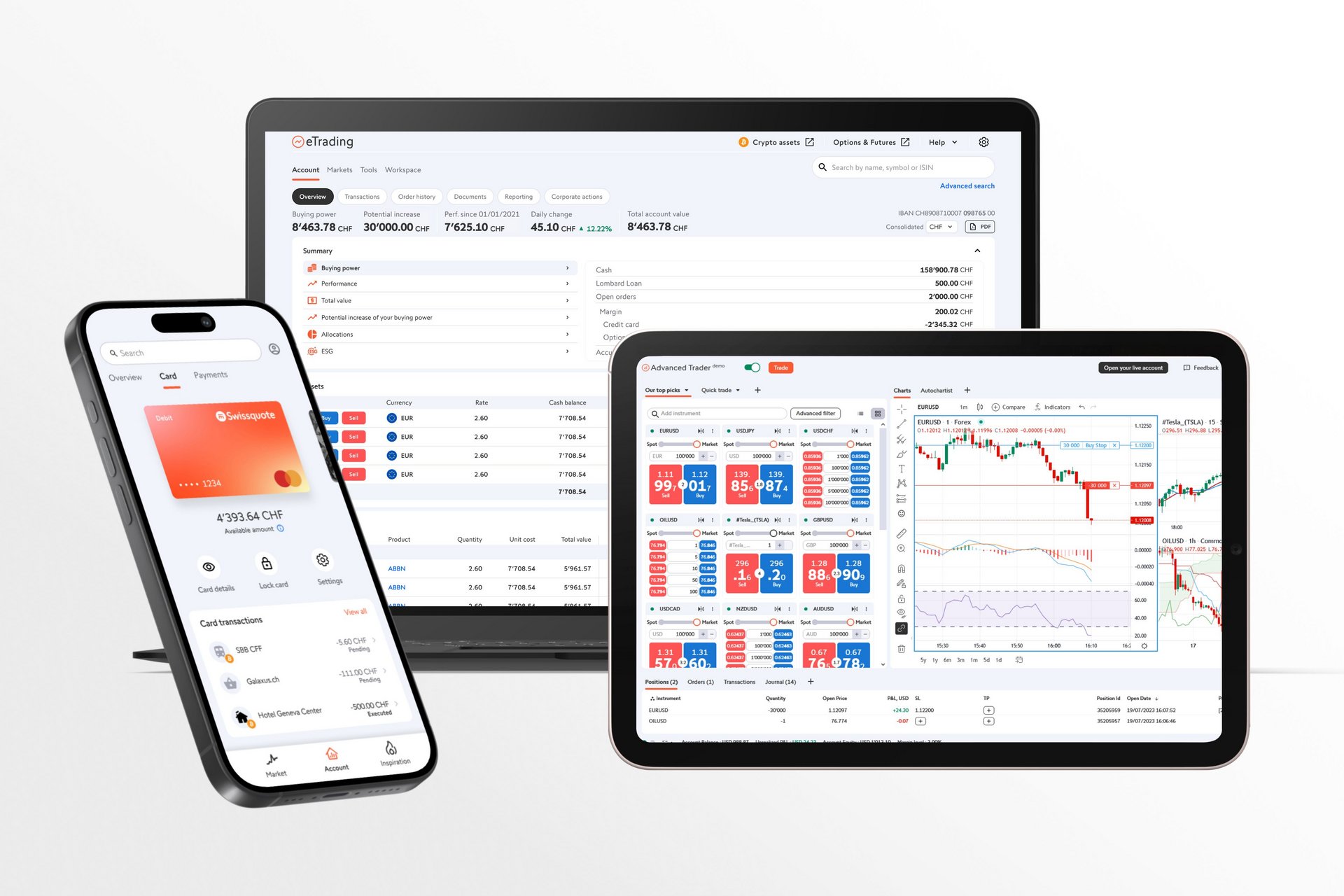

We took additional targeted steps towards creating a digital universal bank during the 2023 financial year by introducing a range of service packages for our clients as well as a debit card supporting foreign currencies and crypto, to make payments seamless and, above all, cost-effective. We also launched two attractive savings and investment solutions in Invest Easy and 3a Easy. We reached another major milestone during the past financial year by paying our investors interest on their trading accounts again at last from May 2023 onwards. Another group to benefit from the improvement in market conditions were the more than 200’000 Yuh customers, who no longer have balance limits on the interest they can earn.

SUSTAINABILITY

SUSTAINABILITY

SUSTAINABILITY

SUSTAINABILITY

Sustainability plays an important role within our business. Since 2020, we have published a sustainability report in accordance with the GRI Standards, as part of our non-financial reporting. In addition to economic data, investors on our trading platform can also find individual ESG scores as well as a breakdown of environmental, social and governance ratings for a wide variety of companies, enabling them to build their own personal impact portfolio. In the first half of the year, Sustainalytics gave us an ESG rating of “medium risk” to “low risk”. We are proud to be recognised for our efforts in this area.

CRYPTOCURRENCIES

Is spring just around the corner for the crypto market?

Swissquote clients have been able to invest in cryptocurrencies since 2017 and trade safely and cost-effectively on our own SQX crypto exchange since 2022. After something of a winter for cryptocurrencies in which the negative performance of many cryptos made investors extremely wary, we are now seeing growing demand for digital assets. We also expect a further uptick in approvals of various ETFs that invest directly in cryptocurrencies. As demand increases, so do compliance requirements, prompting us to step up our efforts in this area. I am confident that stricter regulation will build confidence in the sector and promote new product applications as well as collaborations with the traditional financial world.

Guidance

Guidance

Guidance

Guidance for 2024

By consistently striving to strategically diversify our business activities and expand our target markets, we have significantly reduced our reliance on the volatile market environment and transaction-dependent income. This ensures that we are equipped to handle multiple eventualities and are confident in our ability to achieve our targets of CHF 595 million in revenue and CHF 300 million in pre-tax profit in 2024.

Letter to the shareholders

Dear shareholders,

Despite a challenging environment, Swissquote achieved stronger results than ever with an operating income of CHF 530.9 million, an operating profit of CHF 255.4 million and client assets reaching CHF 58.0 billion in 2023. During this period, Swissquote diversified its revenue streams not only by expanding beyond transaction-based earnings, but also by growing its revenues from international clients in Europe, Asia, and the Middle East. For the first time, non-transaction-based revenues (58%) exceeded transaction-based revenues (42%) and internationally located customers represented a bigger share of net revenues than Swiss residents (51% and 49%, respectively). Looking ahead, Swissquote expects to continue to grow in 2024, and is confirming its operating profit target for 2025 (CHF 350 million). The Board of Directors is proposing a dividend of CHF 4.30 per share.

Growth led by revenue diversification

In 2023, operating income reached CHF 530.9 million, an increase of 30.1% compared to the previous year (CHF 408.1 million). This favourable development was mainly supported by continued growth in net interest income (CHF 213.1 million), as a result of higher interest rates on all major currencies and resilient cash deposits (15% of total client assets). Net fee and commission income (excluding crypto assets) decreased by 4.0%, reflecting a low level of customer activity. Net crypto assets income decreased by 31.9%. 2023 was generally a year of low volatility for the crypto market, particularly in the first nine months. Crypto assets volatility improved in the last part of 2023, mainly driven by excitement around better conditions in 2024. Net eForex income decreased by 2.7% in 2023. Even though both eForex assets and volumes grew in comparison to the previous year, the low volatility, which dominated FX markets, affected the profitability of the eForex volumes. Net trading income (excluding eForex) increased by 1.5%, supported by the development of new products and services (e.g. debit cards and payments).

Improved operating profit margin at 48.1%

At CHF 270.9 million, total expenses increased by 26% mainly due to increased payroll & related expenses and other operating expenses. As of 31 December 2023, the total headcount was up by 78 to 1’134 FTE (+7.4%), due primarily to hiring in the field of technology and at the level of foreign offices. In 2023, the operating profit increased by 37% to a new record level of CHF 255.4 million (CHF 186.4 million). The operating profit margin grew to 48.1% (45.7%), while the net profit increased to CHF 217.6 million (CHF 157.4 million), with the net profit margin rising to 41.0% (38.6%).

Trading accounts grew by +7.2% in 12 months

A total of 574’274 client accounts was reached at the end of 2023, a net increase of 35’328 accounts or 6.6%. The number of Trading accounts grew by 7.2% in the last 12 months, reflecting intact customer interest in a year of rising interest rates. The implementation of more accessible investment strategies such as “Invest Easy” triggered a solid 14.9% growth in Robo-advisory/Saving accounts. The number of active eForex accounts (inactive eForex accounts are not reported) decreased by 4.3%, but the eForex assets continued to show growth (+7.2%).

Overall, total client assets grew by 11.1% to an all-time high of CHF 58.0 billion (CHF 52.2 billion). This positive development results from a net new money inflow of CHF 5.0 billion (CHF 7.7 billion) and a positive market impact. The strength of the Swiss franc affected both client assets and net new monies (translated from foreign currency to CHF for reporting purposes).

Thanks to solid equity position, payout ratio at 30%

As of 31 December 2023, total balance sheet assets amounted to CHF 10.0 billion (CHF 10.2 billion). Bolstered by a combination of solid profitability and cautious balance sheet management, total equity grew by 21.2% to CHF 898.6 million (CHF 741.1 million). The capital ratio increased further to 25.1% (24.8%), well above the regulatory limit of 11.2%. In that context, the Board of Directors strives for a stable dividend policy. The payout ratio to shareholders should generally amount to 30% of the reported net profit, i.e. CHF 4.30 per share for 2023 (+95%).

International presence reinforced

Swissquote is announcing the acquisition of Optimatrade Investment Partners (Pty) Ltd, a company domiciled in Cape Town, South Africa. This company, regulated locally as a financial services provider, has been acting as an introducer for Swissquote for more than ten years. In 2023, the related commission expenses incurred by Swissquote represented approximately 0.4% of net revenues. The transaction will enable natural synergies, in particular when rebranding Optimatrade. The current CEO and founder of Optimatrade, a Swiss national living in South Africa, will pursue his role in the company. The transaction was completed on 1 March 2024.

Yuh mobile app close to 200’000 customers

In 2023, the mobile finance app Yuh, Swissquote’s 50% joint venture, successfully increased the number of accounts from 106’853 to 193’175 (+80.8%) and its client assets from CHF 0.6 billion to CHF 1.4 billion (+141.9%). During 2023, the net operating profit contribution of Yuh was still negative by –CHF 5.0 million (–CHF 6.7 million).

In 2024, this contribution is still expected to be negative, but to a lesser extent. Early 2024, the number of Yuh accounts surpassed 200’000.

Further upgrades in non-financial reporting

In addition to the GRI standards that we have applied since 2020, the Sustainability Report 2023 contains new disclosures prepared in accordance with the framework developed by the Task Force on Climate-related Financial Disclosures (TCFD). As a result, the report provides additional climate-related information, in line with the new climate strategy and climate risk management framework adopted by the Board of Directors in 2023. At the centre of the Group’s sustainability strategy lies the double materiality assessment, which has been fully revised in 2023. The materiality assessment is a cornerstone of the Group’s sustainability strategy and guides the Board of Directors in the setting of the objectives to the Executive Management and the whole organisation. In 2023, Swissquote was able to improve its Sustainalytics ESG rating from “medium” to “low” risk, confirming the successful concretisation of its efforts in that field. At this year’s annual General Meeting, the shareholders will for the first time vote on the Sustainability Report, which serves as the report on non-financial matters newly required by the Swiss Code of Obligations. In that context, the Sustainability Report was subject to a larger scope of external assurance, including with respect to an extended selection of indicators and non-financial disclosures.

Corporate governance and remuneration

In 2023, Swissquote continued its intense dialogue with shareholders and had the opportunity to discuss topics such as corporate governance, remuneration and sustainability. Swissquote reviewed and evaluated the points raised by shareholders as they contribute to the improvement of Swissquote’s practices, especially in terms of disclosure. In particular, the Board of Directors decided to improve disclosure on its members’ qualifications, which are now presented in a detailed table in the Corporate Governance Report in line with best practice.

Concerning the composition of the Board, Esther Finidori was elected at the annual General Meeting of 10 May 2023. She has a strong expertise in sustainability in general and in environmental aspects and digital transformation specifically. Thanks to her election, the representation of the underrepresented gender reached 37.5%, hence exceeding the target set at 30%. At the level of the Executive Management, Swissquote welcomed Nestor Verrier at the position of Chief Operating Officer as from 1 January 2024, following Lino Finini’s retirement as of 31 December 2023 after more than two decades of working for Swissquote.

With respect to remuneration, shareholders appreciated Swissquote’s response to the comments made previously, in particular regarding the following two points: the disclosure of the metrics of the objectives set to the Executive Management as part of the Short-term Incentive Plan (STIP) and the re-balancing of the Executive Management’s variable remuneration towards the longer term via the partial payment of the annual bonus in shares blocked for three years. Shareholders equally valued the Board of Directors’ decision to put in place a new board and committee fee structure.

Swissquote greatly appreciated the time and active participation of its shareholders and is looking forward to maintaining this valuable dialogue in the future.

Thanks

On behalf of the Board of Directors and the Executive Management, we would like to thank our clients for their loyalty and contribution to Swissquote’s success and long-term solidity. Thanks to their informed feedback, suggestions and requests, we continuously seek to improve and innovate to deliver exceptional and refreshing banking experiences. Furthermore, we would like to thank our shareholders for the trust they place in us, and all our employees for their hard work and commitment. And finally, we extend our thanks to our cooperation partners for their collaboration and unfailing expertise in helping us to grow our business.

|

|

| Markus Dennler Chairman of the Board | Marc Bürki Chief Executive Officer |

Highlights 2023

Mar

Swissquote’s net revenues and pre-tax profit at guidance; 2023 eyes at all-time records

With net revenues of CHF 408.0 million, a pre-tax profit of CHF 186.4 million and net new monies of CHF 7.7 billion, Swissquote is reporting robust and qualitatively strong numbers for 2022. The diversification of revenue streams enabled Swissquote to benefit specifically from the change in short term interest rates. In 2022, 51’099 new client accounts (+10.5 percent) contributed to further growth, while total client assets reached CHF 52.2 billion. Swissquote anticipates a promising 2023 with new records in revenues and profit targeted.

Apr

Swissquote brings interest back to trading account

After the general turnaround in interest rates has already ensured rising interest rates on savings accounts, Swissquote is going a step further and brings back interest rates as of 1 May 2023 on private accounts/trading accounts as well. The positive interest rates apply to all customers, for deposits of any amount. Withdrawals are possible at any time and free of charge. Furthermore, Swissquote trading accounts have no maintenance fees.

May

Swissquote, Stableton and Morningstar Indexes collaborate to introduce Private Market Investment products focusing on the Top 20 Unicorns

Investing in private markets can be difficult and time-consuming. Available options typically demand high investment minimums, capital calls, long-term fund commitments, opaque “black-box” investments, and high fees. A first-of-its-kind range of investment products, where the strategy aims to broadly reflect the holdings of a private market index, now gives institutional and private investors, including retail investors, easy and convenient access to privately held high-growth companies.

Jul

Invest Easy: Swissquote introduces the investment and saving solution for simplicity seekers

Swissquote launches one-click investments with four professionally predefined strategies, highly competitive interest rates of up to 2% on cash deposits, depending on currency, and low-to-no-fees. In its initial phase, Invest Easy provides four professionally predefined strategies with tiered growth opportunities and risk profiles for fast, easy and intuitive investment decisions.

Aug

Results for the first half of 2023 – Swissquote reports record-high net revenues and client assets. Full-year guidance increased

While the first half of 2023 was challenging for investors and trading activity remained low across the industry, Swissquote can report strong results that exceeded initial expectations.

- Net revenues: CHF 265.6 million (+32.8%)

- Pre-tax profit: CHF 124.9 million (+37.7%)

- Client assets: CHF 56.9 billion

- Client accounts: 555,266 (+6.4%)

For 2023 as a whole, Swissquote is now targeting a pre-tax profit of around CHF 250 million (initially: CHF 230 million).

Sep

Swissquote appoints Nestor Verrier as future Chief Operating Officer

As announced in March, Swissquote’s current COO, Lino Finini, will retire at the end of 2023. Nestor Verrier was appointed to replace him as of 1 January 2024. “We are pleased to welcome Nestor as our new COO from January 2024”, says Marc Bürki, CEO of Swissquote. “He is highly valued by our team for his leadership work. With his international and technologically oriented background, he was the natural successor of our COO.”

Sep

Multi-currency and crypto-friendly: Swissquote introduces its new debit card and complete daily banking packages

Swissquote is taking the next step towards becoming the first universal digital bank by introducing two complete daily banking packages. The packages include comprehensive daily banking services, a multi-currency and crypto-friendly Swissquote Debit Mastercard®, a wide range of popular payment solutions, and an attractive cashback program. Altogether, these new packages make payments seamless and rewarding, while their attractive low-to-no-fees pricing is always fully transparent.